Executive Summary

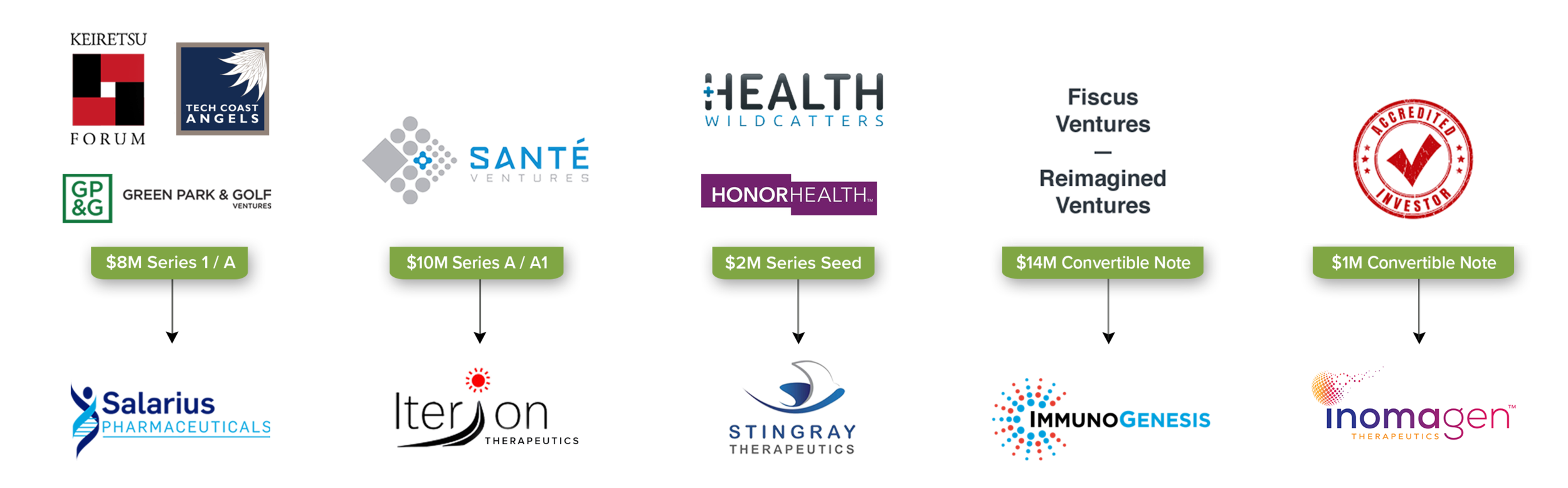

SJA exceeds client financing objectives by leveraging the company’s extensive network of institutional, angel group syndicates, and alternative investors (accredited, family offices) to finance early to mid-stage biotech companies through major value inflection points / milestones.

Effective at negotiating and closing Series / convertible preferred rounds with institutional capital sources (venture capital, cross-over) and identifying / gaining commitment from Lead Investors pivotal to attracting syndicates.

Extensive Investor Network

- Accredited / high-net-worth investors

- Family offices

- Institutional investors (e.g. Venture Capital)

- Cross-over (SPAC / PIPES) / hedge funds